How brands use equity to exploit content creators & not pay them

Last updated on July 21st, 2025 at 11:31 pm

How do influencers get paid? Should content creators accept company equity as compensation?

Creators and influencers don’t know how much money to charge or even how to get paid for their work.

Which allows brands to exploit influencers and get away with not paying them.

Brands tend to offer free products as a form of compensation for influencer work.

However, there have been instances where companies will offer something called equity instead of cash.

Equity could be worth a lot of money. Or it could be worth nothing.

Let’s talk about:

- examples of how companies are using equity to either underpay creators or to get away with not paying creators at all

- the types of equity and the pros & cons

- resources to learn more about company equity

Disclaimer: This is not financial advice. The article is meant to provide a quick overview so that you can conduct your own research and seek legal & financial advice from legal & financial professionals.

Note: This post contains affiliate links. If you make a purchase, I’ll earn a commission at no extra charge to you. Read more on the Disclaimer page and thank you for your support.

Influencer compensation & exploitation

David Warren & Triller

David Warren is a content creator with 500k+ followers and 14M+ views on TikTok who signed a deal with Triller, an app that’s supposed to be a TikTok rival.

According to an article in The Washington Post, Triller promised Warren and other creators $4,000 per month, half in equity, to post videos on their platform every month.

Warren and other creators, say that they have not been paid for their work, nor have they been allocated Triller shares.

Some of these creators said that they are dealing with debt and evictions as a result of not being paid by Triller.

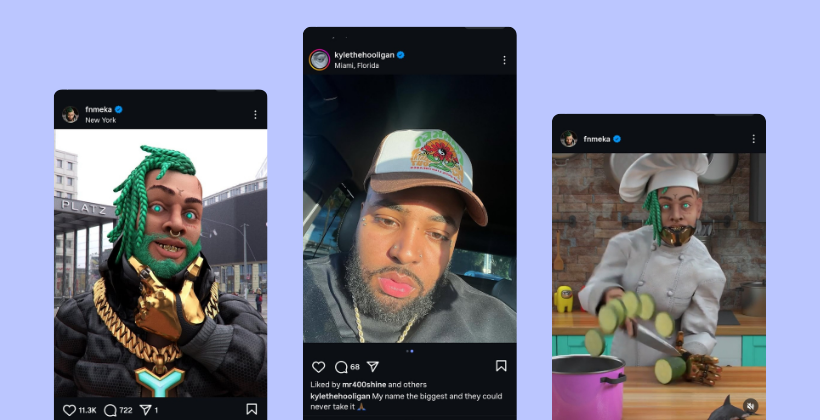

Kyle The Hooligan & FN Meka

The AI rapper, FN Meka, which was created by the company Factory New, has gone viral several times.

Both the company and the virtual rapper have been accused of cultural appropriation.

Kyle The Hooligan, a Houston-based rapper, and actual person, is the voice behind FN Meka.

In this Vice interview, he states that he wrote and performed songs and was a part of the Factory New team who crafted and shaped FN Meka.

He was promised equity as “payment” for his work, but was never compensated and completely ghosted by Factory New.

Keep in mind that in both of these examples involve the exploitation of Black creators.

Any creator or influencer can be taken advantage of but Black creators can be more susceptible to exploitation due to discrimination, racism and other factors.

My hope is that by continuing to share these stories, companies will have a harder time getting free work from creators and influencers.

Things to know about equity

This is not a comprehensive guide on how to get paid as a creative or influencer.

This is also not financial advice or legal advice.

Eventually, I want to turn this into a series or a guide, but for now, this is a quick overview with resources to introduce you to the concept of equity.

What is equity?

Equity is shares (also known as stocks) in a company.

Equity is usually offered to full-time permanent employees and/or long-term project collaborators.

The equity is often offered in addition to salary, benefits, and other incentives.

Typically, people only accept (or purchase) equity in a company if they believe in that company and are personally invested in its growth.

The whole point of having company shares is to make additional money.

The idea is to obtain the shares at a lower price, and then sell those shares for a higher price in the future.

Types of equity

There are different types of equity.

If the company is public, then the company might offer Restricted Stock Units (RSUs).

The price of each share depends on how the company is doing in the stock market, which means that the share price can change at any time, and sometimes drastically.

If the company is private, then it gets much more complicated.

But to be clear, it is highly unlikely that you can pay this month’s (or next month’s) bills with equity.

What are some of the pros & cons of equity?

Call it a hot take or an unpopular opinion but equity, in a lot of cases, is not an acceptable form of payment.

Especially, if “getting paid in equity” is the only way you’ll be “paid”.

There are stories of people becoming millionaires (and billionaires) thanks to the equity they held in a company after the company was acquired (bought by another company) or went public.

But there are also stories of people whose equity became worthless or they lost a lot of their would-be earnings to taxes.

Must read: How to Turn a Gifted Collaboration into a Paid Sponsorship

Additional resources to learn more about equity

The point of this breakdown is not to discourage you from getting equity, but to inform you of the nuances and complications that come with receiving equity from a company.

With equity, there’s an amazing opportunity to make a lot of money, but there are serious risks and pitfalls involved as well.

I kept it pretty light here but if you want to learn more, here’s some additional reading:

Levels.fyi

This Levels.fyi blog post has a section on equity as it relates to total compensation for tech employees. It focuses mainly on RSUs, and gives an example of a vesting schedule. Another Levels.fyi post is a deeper dive into equity and details how to negotiate equity as a part of your job offer. And it lists questions you need to ask about your equity offer.

U.S. Securities & Exchange Commission (SEC)

The SEC explains equity but mainly from the perspective of having shares from a public company. They list some of the types of stocks and risks associated with stocks.

Venture Deals by Brad Feld & Jason Mendelson

If you are an entrepreneur planning to raise money for your business through angel investors, venture capitalists (VCs), equity crowdfunding, etc, then this is a great read.

How to negotiate paid opportunities with brands

If you’ve decided that equity is not right for you, these are some tips and talking points on how to turn an unpaid or gifted collaboration with a brand into a paid opportunity.

What else do you want to know about equity?

Email me at hey [at] profoodmaker [dot] com, or tweet @profoodmakerpod to let me know your thoughts and questions about equity for future articles.